What new Ocean Alliances mean for shipping

Originally posted by Shippeo here.

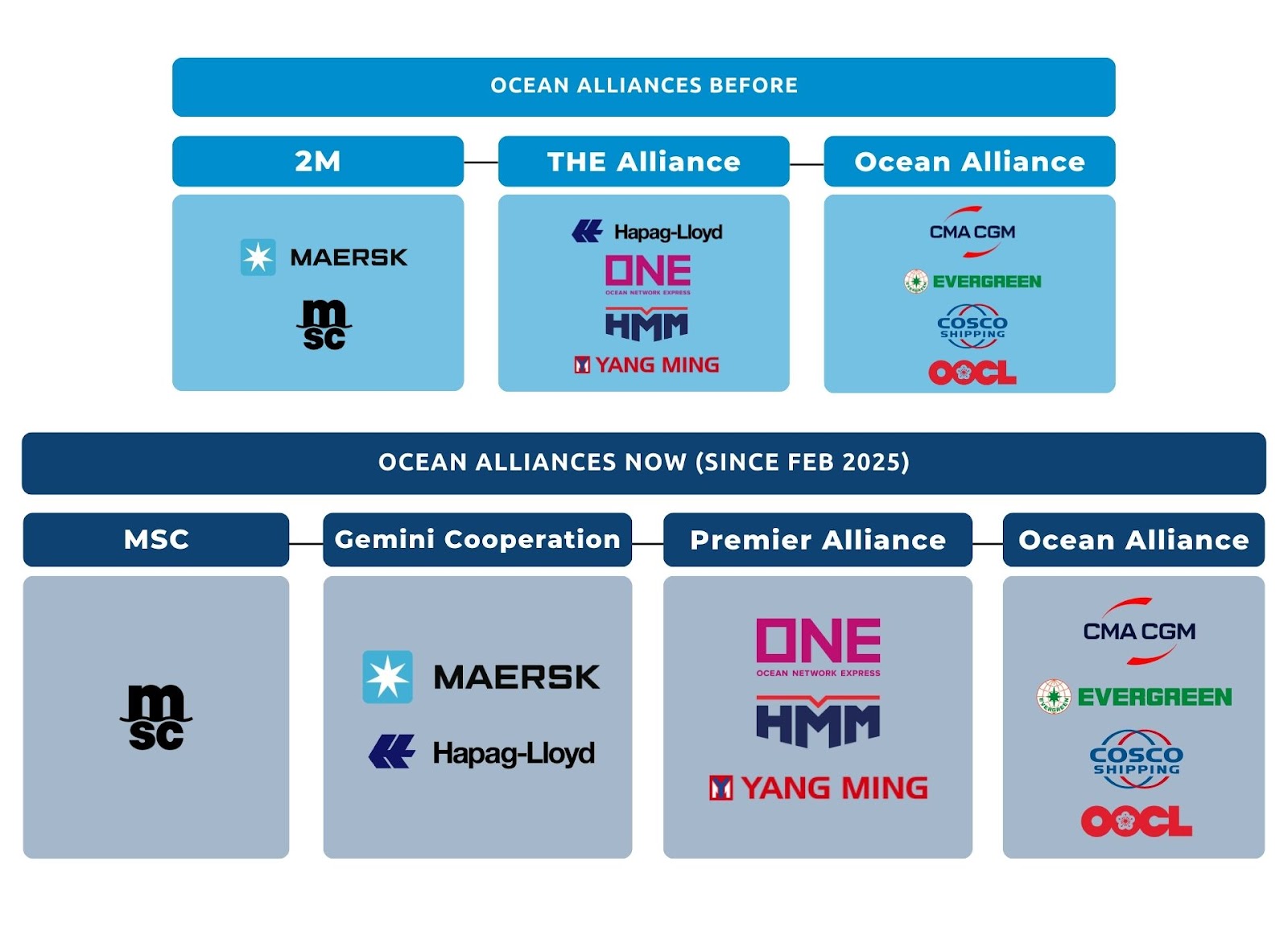

As if current times weren’t turbulent enough for international supply chains, since February 2025, there’s been a new fundamental factor to deal with: existing ocean alliances are being reshuffled, and MSC has chosen to go it alone.

The biggest changes are MSC going its own way; and Hapag-Lloyd joining Maersk in the brand new Gemini Cooperation (thereby leaving THE Alliance, known from now on as the Premier Alliance). The Ocean Alliance remains unchanged.

Whilst our graphic portrays the bigger picture, the main novelty is Gemini’s proposal of a new way of working. Its “hub-and-spoke” system will see smaller shuttle ships serving more destinations at the outer edges of larger ships’ rotations. All other shippers, led by MSC, will continue the more traditional approach of trying to serve as many port-to-port combinations as possible.

So what does this mean for your shipments moving forwards? Let’s have a look…

For now: More congestion and blank sailings; Lower data quality

New alliances mean new schedules. New schedules mean some routes will be discontinued, whilst others will be modified. This means less predictable departure and arrival times, and as such less reliable ETAs (full disclosure: this is as problematic for Shippeo as it is for our clients) and more blank sailings.

Add to this external factors such as:

- China, the world’s largest container shipping market, has stopped building new port capacity, which will inevitably make Shanghai and Ningbo the world’s most congested (JOC)

- The US’ plans to charge Chinese ships docking in American ports

- Ongoing disruption around the Red Sea

- And the unprecedented turbulence caused by Trump’s tariffs since “Liberation Day”…

…and you have a uniquely complicated situation for global shipping.

That said, blank sailings are not always a bad thing. “There will be skipped sailings” due to new ocean alliances, Alphaliner senior analyst Stefan Verberckmoes told the Journal of Commerce, “but it will certainly not be chaos.”

Notably because “blank sailings are absolutely not random”, Lars Jensen, CEO of Vespucci Maritime insisted during a Searoutes-hosted webinar last month. “If I’m a major alliance and I have, say, 6 weekly services, if some weeks demand is down 15% and it makes more sense for me to have 5 services, I can still move the cargo. [Blank sailings] will not go away. This indeed is how they’ve designed their networks.”

A more troublesome consequence of the new alliances could be the impact of modified schedules on the data quality upon which TMS & RTTV systems rely.

“Carriers only coordinate within their own alliances,” said Jensen. “When all four alliances are sending in 2 ships on the same weekday, [you get] inevitable massive congestion.”

Searoutes CEO Pierre Garreau as such asserts “we should expect the data that we get from [carriers] directly to drop in terms of quality.” On the same webinar, Marko Hahn, Global Logistics Procurement at BASF, bemoaned the fact that, already, “we do not get the updates that we’re happy with at the moment… even the [carriers] with very sophisticated systems, that information is not getting into our system in time.”

For later: More reliability and affordability?

Reliability is indeed the core issue behind the new ocean alliances. Gemini Cooperation is taking a major gamble by choosing to be the only alliance trying to solve this issue, by eschewing the traditional port-to-port system and experimenting with a hub-and-spoke method.

Whilst the gamble is indeed considerable – Gemini launched with a promise of 90% reliability, whereas in November 2024, the industry average was 55%, according to Sea-Intelligence Maritime Analysis (via JOC) – it may yet make sense. As Jensen explains, hub-and-spoke is “cheaper because, at the outer edges of your rotation, large ships will be poorly utilized. Smaller ships will have a higher degree of utilization, simply because they’re smaller. A direct is not always faster than a transshipment.”

That promise of 90% reliability was last met in 2019 in Asia, by the former 2M alliance comprised of MSC and Maersk, according to Jensen. Can half of that old alliance meet this lofty target once again?

“Everybody has become jaded over the last five years: nothing has run on time for any carrier,” adds Jensen. “So I can understand why a lot of shippers want to see it before they believe it. Do you trust Gemini to make that connection? I’ve gathered from quite a few BCOs that no, the trust is not quite there.”

“It’s about trust at the moment”, BASF’s Hahn agreed.

At least, Jensen demurred, the new alliances should help shipping costs become more affordable again, simply because four alliances instead of three “should increase the competitive pressure.” And if hub-and-spoke is indeed cheaper for shippers, Gemini Cooperation may be onto a winner. If it can regain that aforementioned trust, perhaps…

For you: Visibility counts more than ever

In short, whilst new ocean alliances could at first disrupt shipping schedules and make ETAs less predictable, the motivation behind these moves is precisely to inverse that trend: more reliability is, naturally, good for ETA precision. So the sooner they help reliability move away from 55% and towards 90%, the better.

Meanwhile, count on Shippeo to keep a close eye on all potential disruptions, both fundamental like this one, and more time-sensitive turbulences (think tariffs and black swans). RTTV allows shippers to better understand and anticipate such uncertain times. Indeed, when things are this challenging is precisely when visibility is the most required. So be sure to reach out for help!

James Martin

Senior Communications & Content Manager

–

Shippeo