EU ETS in 2026: Why Shippers and Forwarders Can’t Afford to Ignore the Rising Cost of Carbon

What is EU ETS and Why Does It Matter?

The EU Emissions Trading System (EU ETS) is a cornerstone of the EU’s policy to combat climate change by capping and reducing greenhouse gas emissions. Since January 2024, it has included maritime shipping, requiring carriers to purchase allowances for CO₂e emissions on voyages to, from, or within the EU.

Who pays?

While carriers are legally responsible for compliance, the cost is passed directly to shippers and freight forwarders through surcharges. With freight rates fluctuating and regulatory baselines rising, these charges now represent a significant—and growing—portion of shipping costs.

The Hidden Impact: EU ETS Surcharges in a Volatile Market

The introduction of EU ETS coincided with the Red Sea crisis, which overshadowed its impact as freight rates soared. Initially, the surcharge added just 1% to shipping costs—a drop in the ocean for shippers scrambling to secure capacity.

But in 2026, the picture is starkly different:

- Freight rates have fallen from their 2024 peaks, while EU ETS costs have risen due to stricter baselines.

- Surcharges now average $168 per dry 40ft container from Asia to North Europe—6-7% of the base freight rate (up from 1% in 2024).

- If Red Sea routes reopen and rates drop further, this could balloon to 12% or more of total costs.

The Carrier Patchwork: How Surcharges Vary

Carriers have adopted different names (and pricing) for EU ETS surcharges, creating confusion.

Here’s how they compare for Q1 2026:

EU ETS Charges by Carrier (USD per dry TEU, Q1 2026)

| Gemini | Ocean | Premier | ||

| MAERSK | HAPAG LLOYD | CMA CGM | ONE | |

| East Asia to North Europe | 84 | 82 | 84 | 93 |

| East Asia to Mediterranean | 65 | 87 | 67 | 42 |

| North Europe to North America WC | 70 | 61 | 95 | 61 |

| Intra North Europe | 16 | 49 | 55 | 83 |

Key takeaway: The same route can cost twice as much depending on the carrier—highlighting the need for transparency and strategic planning.

Case Study: The True Cost of EU ETS on Key Routes

Let’s break down two examples from the Searoutes data for a Asia to Europe Transport:

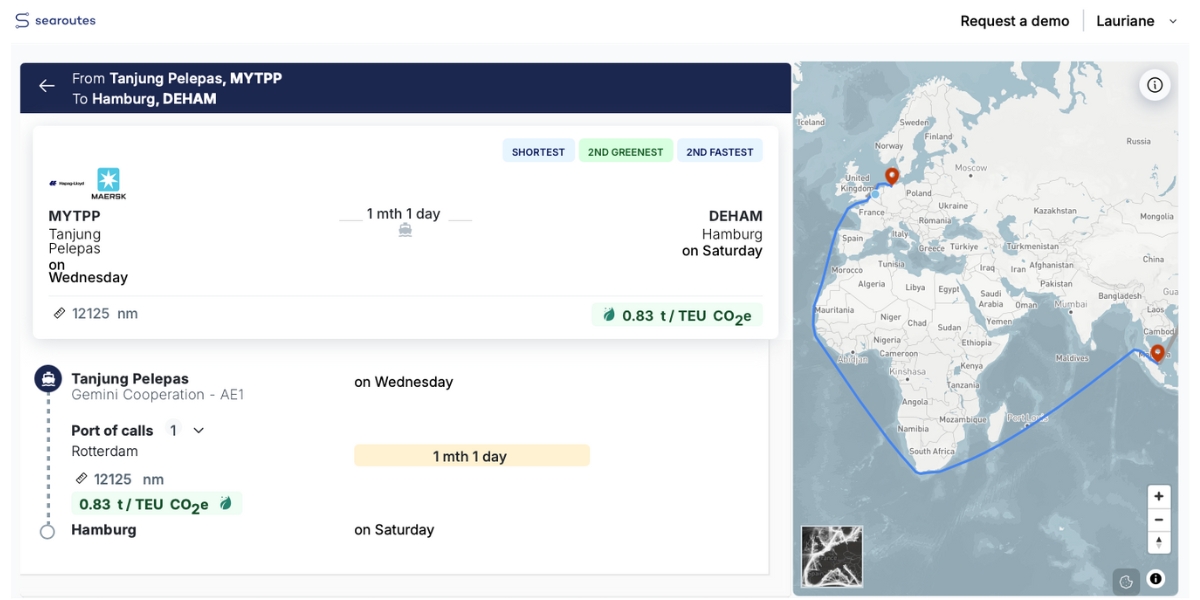

- Gemini AE1 which travel from Shanghai to Hamburg for a Tanjung Pelepas to EU:

- EU ETS distance: 12,125 nm (89% of total voyage)

- Surcharge range: $30–45 per TEU

- Impact: High exposure due to long EU-applicable distance.

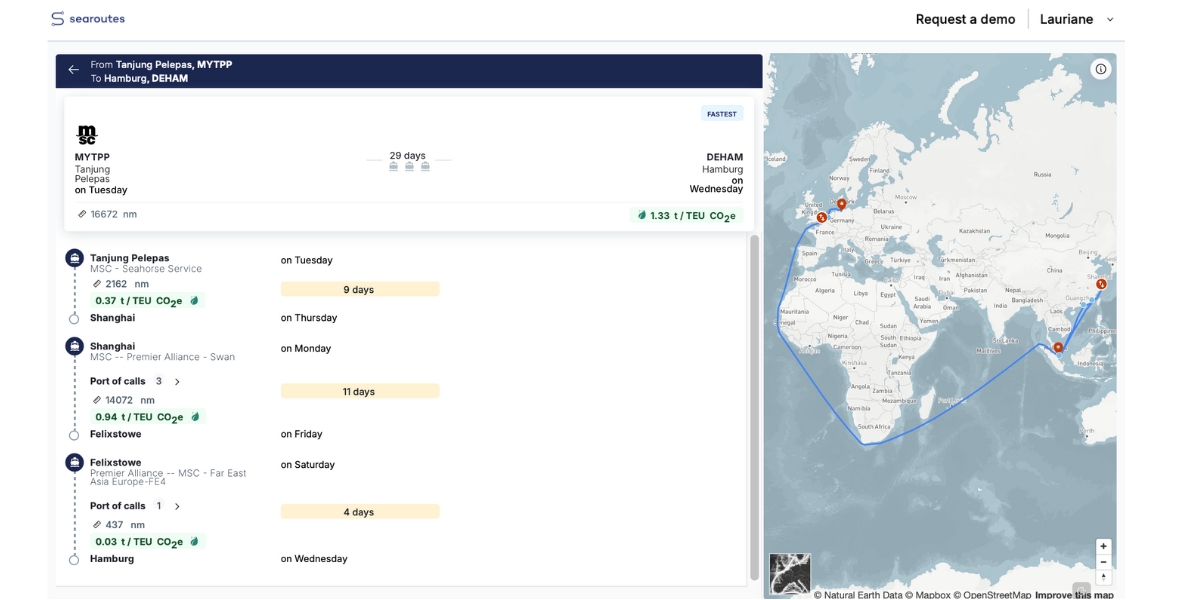

- MSC/Premier FE (Felixstowe to EU):

- EU ETS distance: 448 nm (3% of total voyage)

- Surcharge range: $3–10 per TEU

- Impact: Minimal, but still a cost to factor in.

EU ETS Distance and Cost Impact (Q1 2026)

| Service | Last call before EU | EU ETS applicable distance | Expected EU ETS charges range, per TEU |

| Gemini, AE1 | Tanjung Pelepas | 89 % | 30 – 45 USD |

| Gemini, AE5 | London Gateway | 3 % | 3 – 10 USD |

| Ocean, FAL3 | Singapore | 89 % | 30 – 45 USD |

| MSC & Premier, FE4 | Felixstowe | 3 % | 3 – 10 USD |

There is a clear benefit of choosing services that provide opportunities to lower these costs.

Why Shippers Must Act Now

- Budget Planning: EU ETS is no longer negligible. At 6-12% of freight costs, it demands proactive budgeting.

- Carrier Selection: With surcharges varying widely, choosing the right carrier can cut costs.

- Route Optimization: Avoiding EU ports or consolidating shipments can reduce ETS exposure.

- Data-Driven Decisions: Tools like Searoutes’ emissions tracking help model ETS costs and explore alternatives.

Conclusion: Turn Compliance into Competitive Advantage

EU ETS is here to stay—and its financial impact will only grow. Shippers who understand the surcharges, compare carriers, and optimize routes will mitigate costs and gain an edge.

The time to act is now. Are you tracking your EU ETS exposure? Searoutes has developed an EU ETS dashboard to support your monitor and planning on EU ETS surcharges. It is part of our Business Package, request a demo now.