Scope 3 Emissions in Maritime Shipping: 2025 Guide & Best Practices

Updated: September 2025

Introduction

As global trade and consumer demand continue to grow, so does the carbon footprint of the world’s supply chains. The transportation of raw materials and finished goods—especially by sea—remains a major source of greenhouse gas (GHG) emissions. In recent years, governments, regulators, and corporations have intensified their focus on Scope 3 emissions, which account for the vast majority of most companies’ carbon footprints.

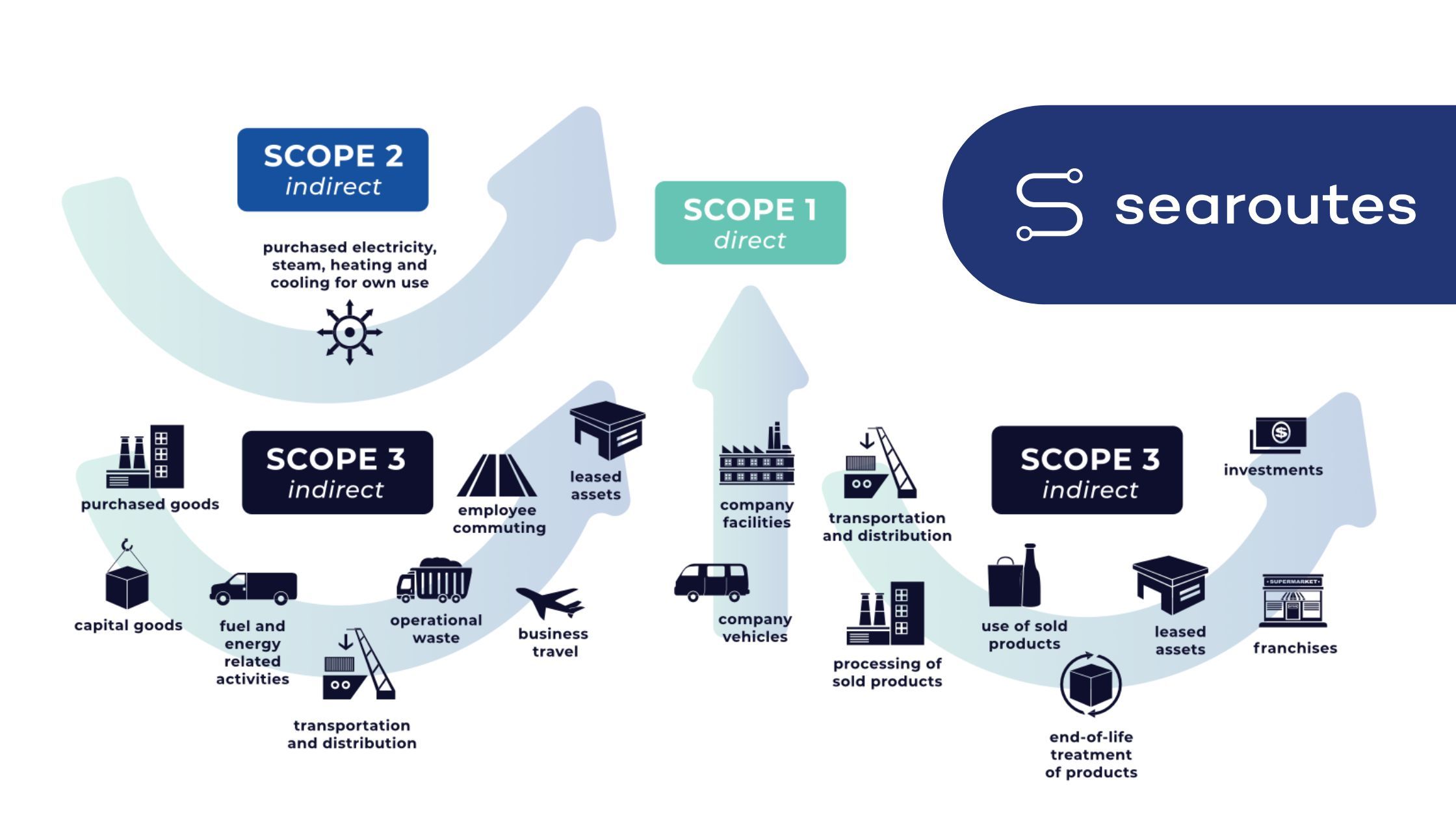

Unlike Scope 1 (direct emissions) and Scope 2 (indirect emissions from purchased energy), Scope 3 emissions occur across the entire value chain, from upstream suppliers to downstream logistics and end-of-life product management. For the maritime industry, where nearly 90% of global trade is transported by sea, Scope 3 emissions are both a challenge and an opportunity for decarbonization.

What Are Scope 3 Emissions, and Why Is Tracking Them Important?

Scope 3 emissions are indirect emissions that occur in a company’s value chain, including both upstream and downstream activities. For shippers, forwarders, and manufacturers, these emissions can arise from:

- Upstream activities: Purchased goods and services, capital goods, fuel and energy-related activities, and transportation and distribution.

- Downstream activities: Use of sold products, end-of-life treatment, and logistics provided by third parties.

Why Scope 3 Matters Now More Than Ever

- Regulatory Pressure: Since 2022, reporting requirements have evolved significantly. The EU Corporate Sustainability Reporting Directive (CSRD) now mandates detailed Scope 3 disclosures for large companies, with the first reports due in 2026. While the U.S. SEC climate disclosure rule does not require Scope 3 reporting, California’s Climate Corporate Data Accountability Act (SB 253) does, covering companies with over $1 billion in revenue.

- Industry Commitments: The International Maritime Organization (IMO) 2023 GHG Strategy sets ambitious targets: net-zero GHG emissions by or around 2050, with interim checkpoints of 20–30% reductions by 2030 and 70–80% by 2040, relative to 2008 levels. These targets are not legally binding yet, but they signal a clear direction for the industry.

- Consumer and Investor Demand: Companies are increasingly held accountable for their full carbon footprint. Investors, customers, and regulators expect transparency and action on Scope 3 emissions, which often represent over 70% of a company’s total emissions.

Where Do Ocean Emissions Rank in the Grand Scheme?

Maritime shipping is responsible for about 3% of global GHG emissions—a figure that could rise to 90–130% of 2008 levels by 2050 without intervention. The IMO’s latest strategy underscores the urgency of reducing these emissions, especially as global trade volumes continue to grow.

Key Challenges in Maritime Scope 3 Emissions

- Fragmented Supply Chains: Multiple stakeholders—ports, vessel operators, freight forwarders, and fuel suppliers—make emissions tracking and reduction efforts complex.

- Dynamic Routes and Conditions: Unlike road or rail, ocean routes are influenced by weather, port congestion, and geopolitical factors, making emissions highly variable.

- Fuel and Technology Transitions: The shift to green ammonia, hydrogen, methanol, and biofuels is underway, but scaling these solutions remains a challenge.

Recent Advances in Tracking and Reducing Scope 3 Emissions

1. Digital Tools and Real-Time Data

- Voyage-Level Tracking: Platforms like Searoutes now offer real-time AIS data, advanced cargo estimation, and precise emissions calculations for each voyage, enabling more accurate reporting and optimization.

- Predictive Analytics: Tools such as NAVIGARE™ and Primavera™ help optimize fleet management, reduce idle time, and minimize fuel consumption.

2. Alternative Fuels and Green Shipping Technologies

- Biofuels and Waste-Based Fuels: Companies like Norden have demonstrated 80–90% lifecycle emissions reductions potential using certified biofuels, with projects already underway to scale these solutions.

- Wind-Assisted Propulsion: Innovations like Cargill’s WindWings or Derudder can reduce fuel use by up to 30% for new-build ships.

- Hydrogen and Ammonia: Pilot projects for hydrogen-powered tugs and ammonia-fueled vessels are in advanced stages, with the first commercial deployments expected by the late 2020s.

3. Collaborative Industry Initiatives

- Green Corridors: Sustainable trade routes, such as those between the EU and Asia, are being developed to prioritize low-carbon shipping and infrastructure.

- Carbon Accounting Frameworks: The Smart Freight Centre and Science Based Targets Initiative (SBTi) provide standardized methods for calculating and reporting maritime emissions, ensuring consistency and avoiding double-counting.

Regulatory Landscape: What’s Changed Since 2022?

EU Corporate Sustainability Reporting Directive (CSRD)

- Scope: Mandates Scope 3 reporting for large companies, with phased implementation starting in 2025.

- Impact: Companies must disclose emissions across their value chains, including maritime logistics.

IMO 2023 GHG Strategy

- Targets: Net-zero by or around 2050, with interim checkpoints for 2030 and 2040.

- Measures: Future regulations may include a global fuel standard and carbon pricing mechanism to incentivize decarbonization.

U.S. and California Regulations

- SEC Rule: Does not require Scope 3 reporting, but companies must disclose material climate risks.

- California SB 253: Mandates Scope 3 disclosures for companies with over $1 billion in revenue, starting in 2026.

How Can Your Company Address Scope 3 Emissions?

- Map Your Value Chain: Identify all sources of Scope 3 emissions, from raw material extraction to product delivery.

- Leverage Digital Tools: Use platforms like Searoutes for real-time emissions tracking and optimization.

- Collaborate with Partners: Work with carriers, ports, and fuel suppliers to adopt low-carbon fuels and technologies.

- Set Science-Based Targets: Align your emissions reduction goals with the SBTi and IMO 2023 Strategy.

- Invest in Innovation: Explore alternative fuels, wind-assisted propulsion, and carbon capture technologies for long-term decarbonization.

Conclusion

Scope 3 emissions are no longer optional to track—they are a business imperative. With regulatory pressures mounting, consumer expectations rising, and technological solutions advancing, companies that proactively address their maritime Scope 3 emissions will gain a competitive edge.

For those ready to take action, tools like Searoutes offer the data and insights needed to navigate this complex landscape. By embracing transparency, collaboration, and innovation, the maritime industry can turn the challenge of Scope 3 emissions into an opportunity for sustainable growth.

Ready to reduce your maritime Scope 3 emissions? Request a demo with Searoutes today.

References

- IMO’s newly revised GHG strategy: What it means for shipping and the Paris Agreement

- CSRD – European Union

- Technical Requirements for 2023 IMO GHG Strategy

- Reducing emissions in logistics | McKinsey

- What are Scope 3 emissions and why do they matter? | The Carbon Trust

- McKinsey: How to reduce Scope 3 emissions

- Navigating mandatory Scope 3 emissions reporting in the EU, US, and beyond

What steps is your company taking to address Scope 3 emissions in your maritime supply chain? Let’s discuss how you can turn these challenges into opportunities.

EU CSRD Scope 3 reporting, IMO GHG strategy 2023, Maritime shipping emissions 2025, Scope 3 emissions maritime